Stocks To Invest In: Your Comprehensive Guide for Smart Investments

Investing in stocks can be a powerful way to grow wealth over time. Whether you’re a beginner or an experienced investor, understanding which stocks to invest in is key to achieving your financial goals. This guide will help you navigate the stock market, explore different sectors, and provide actionable tips to make informed investment decisions.

Table of Contents

- Introduction: Why Investing in Stocks Matters

- Understanding the Stock Market

- Key Factors to Consider When Choosing Stocks to Invest In

- Top Sectors to Watch in 2024

- Best Stocks to Invest In Right Now

- How to Diversify Your Portfolio

- Common Mistakes to Avoid in Stock Investing

- Frequently Asked Questions About Stocks to Invest In

- Conclusion: Building Long-Term Wealth

Introduction: Why Investing in Stocks Matters

Investing in stocks is one of the most popular ways to build wealth over time. Stocks represent ownership in a company, and by investing, you participate in the company’s growth and profitability. Historically, the stock market has outperformed other asset classes, such as bonds and real estate, making it an essential component of any investment portfolio.

But not all stocks are created equal. Choosing the right stocks to invest in requires research, patience, and a strategic approach.

Understanding the Stock Market

Before diving into stocks to invest in, it’s essential to understand how the stock market works.

What is the Stock Market?

The stock market is a collection of exchanges where shares of publicly traded companies are bought and sold. Major exchanges include:

- New York Stock Exchange (NYSE)

- Nasdaq

- London Stock Exchange (LSE)

Why Do Stock Prices Fluctuate?

Stock prices change due to supply and demand, influenced by factors such as:

- Company performance

- Economic conditions

- Market sentiment

- Global events

Understanding these dynamics can help you identify the best stocks to invest in.

Key Factors to Consider When Choosing Stocks to Invest In

Choosing the right stocks can be overwhelming, but focusing on the following factors can make the process easier:

1. Financial Health of the Company

- Review the company’s income statements, balance sheets, and cash flow statements.

- Look for consistent revenue growth and manageable debt levels.

2. Industry Trends

- Invest in industries poised for growth, such as technology, healthcare, or renewable energy.

3. Dividend History

- Companies that pay regular dividends can provide a steady income stream, even in volatile markets.

4. Valuation Metrics

- Use metrics like Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Price-to-Book (P/B) ratio to determine if a stock is overvalued or undervalued.

5. Management and Leadership

- Companies with experienced and visionary leaders are more likely to succeed in the long run.

Top Sectors to Watch in 2024

The stock market is vast, but certain sectors are expected to perform well in 2024 due to economic and technological trends.

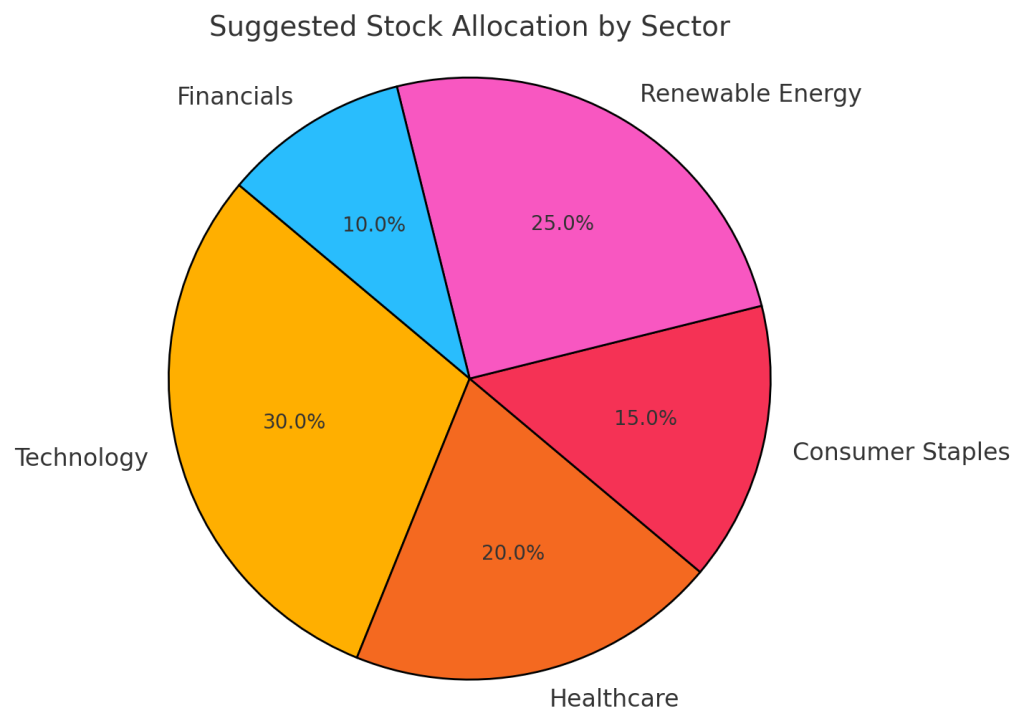

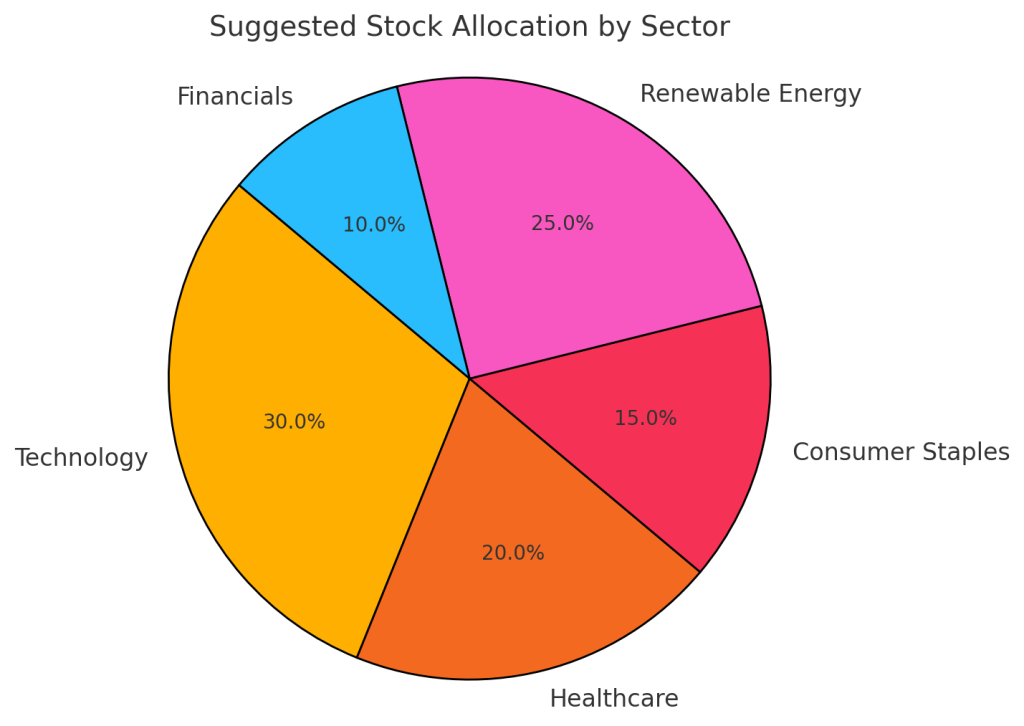

1. Technology

- Innovations in AI, cloud computing, and cybersecurity make technology stocks attractive.

- Companies like Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA) are leaders in this space.

2. Healthcare

- Aging populations and advancements in biotech drive growth in healthcare stocks.

- Consider investing in Johnson & Johnson (JNJ) or Pfizer (PFE).

3. Renewable Energy

- The global push for clean energy boosts demand for solar, wind, and electric vehicle-related stocks.

- Look at Tesla (TSLA), NextEra Energy (NEE), and First Solar (FSLR).

4. Consumer Staples

- Essential goods companies provide stability during economic downturns.

- Strong candidates include Procter & Gamble (PG) and Coca-Cola (KO).

Best Stocks to Invest In Right Now

Here’s a list of some of the top-performing and promising stocks to consider:

1. Apple (AAPL)

- Why It’s a Good Investment: Consistent innovation and a loyal customer base make Apple a reliable choice.

- Growth Potential: Expanding services like Apple Pay and Apple Music drive additional revenue streams.

2. Amazon (AMZN)

- Why It’s a Good Investment: A leader in e-commerce and cloud computing with a strong growth trajectory.

- Growth Potential: The AWS division continues to dominate the cloud market.

3. Tesla (TSLA)

- Why It’s a Good Investment: Tesla remains a leader in the electric vehicle market.

- Growth Potential: Expansion into new markets and advancements in battery technology.

4. Johnson & Johnson (JNJ)

- Why It’s a Good Investment: A diversified healthcare company with a strong track record.

- Growth Potential: Continued innovation in pharmaceuticals and medical devices.

5. Nvidia (NVDA)

- Why It’s a Good Investment: A leader in AI and graphics processing technology.

- Growth Potential: Expanding applications for AI across industries.

How to Diversify Your Portfolio

Diversification is crucial to reducing risk in your investment portfolio.

Steps to Diversify:

- Invest in Different Sectors: Don’t put all your money in one industry.

- Include International Stocks: Gain exposure to global markets by investing in foreign companies.

- Mix Growth and Value Stocks: Balance high-growth companies with undervalued stocks offering steady returns.

- Consider ETFs and Index Funds: These provide instant diversification by pooling investments into a variety of stocks.

Common Mistakes to Avoid in Stock Investing

Investing in the stock market can be rewarding, but it also comes with risks. Here are some common mistakes to avoid:

1. Lack of Research

- Blindly following trends or tips without understanding the company’s fundamentals can lead to losses.

2. Emotional Investing

- Avoid making decisions based on fear or greed. Stick to your strategy.

3. Overtrading

- Frequent buying and selling can rack up fees and reduce returns.

4. Ignoring Diversification

- Concentrating your investments in one stock or sector increases risk.

5. Timing the Market

- Focus on time in the market rather than trying to predict short-term movements.

Frequently Asked Questions About Stocks to Invest In

1. What are the best stocks to invest in for beginners?

Beginner investors should focus on well-established companies with a history of stability, such as Apple (AAPL), Microsoft (MSFT), or index funds like the S&P 500 ETF.

2. How much money do I need to start investing?

You can start investing with as little as $100. Many platforms allow fractional shares, enabling you to invest in expensive stocks with smaller amounts.

3. How often should I review my stock portfolio?

Review your portfolio quarterly or whenever there are significant market changes. Adjust your investments based on performance and goals.

4. Are dividend stocks a good investment?

Yes, dividend stocks can provide a reliable income stream and are often less volatile than growth stocks.

5. Should I invest in individual stocks or ETFs?

Both have advantages. Individual stocks offer higher growth potential, while ETFs provide diversification and reduced risk.

Building Long-Term Wealth

Investing in the right stocks to invest in is a vital step toward achieving financial independence. By researching companies, diversifying your portfolio, and staying informed about market trends, you can make sound investment decisions.

Remember, investing is a long-term journey. Patience, consistency, and ongoing education are your keys to success. Whether you’re just starting out or looking to refine your strategy, the stock market offers opportunities to grow your wealth and secure your financial future.

Start investing today and watch your financial goals come to life!

What are the top stocks globally?

Investing in the global stock market offers opportunities to participate in the growth of leading companies across various sectors. As of December 2, 2024, several stocks have demonstrated strong performance and are considered top picks for investors. Below is a curated list of these leading stocks:

Apple Inc. (AAPL)

A technology giant known for its innovative products like the iPhone and MacBook, Apple continues to show robust financial health and a strong market presence. As of the latest data, AAPL is trading at $237.33, reflecting a positive change of 1.08% from the previous close.

Microsoft Corporation (MSFT)

A leader in software development and cloud computing services, Microsoft has a diverse portfolio contributing to its sustained growth. Currently, MSFT is priced at $423.46, with a slight increase of 0.11% from the previous close.

Amazon.com Inc. (AMZN)

Dominating the e-commerce and cloud computing sectors, Amazon continues to expand its services globally. AMZN shares are trading at $207.89, up by 1.06% from the previous close.

Alphabet Inc. (GOOGL)

As the parent company of Google, Alphabet leads in online search and advertising, with ventures into various tech innovations. GOOGL is currently at $168.95, showing a minor decrease of 0.18% from the previous close.

Tesla Inc. (TSLA)

Pioneering in electric vehicles and renewable energy solutions, Tesla has seen significant growth. TSLA is trading at $345.16, marking a substantial rise of 3.67% from the previous close.

Berkshire Hathaway Inc. (BRK.A)

A conglomerate with diverse holdings in various industries, Berkshire Hathaway is known for its value investing approach. BRK.A shares are priced at $724,040.00, up by 0.08% from the previous close.

NVIDIA Corp (NVDA)

Specializing in graphics processing units and AI technology, NVIDIA has experienced rapid growth. NVDA is currently at $138.25, with a 2.16% increase from the previous close.

Meta Platforms Inc. (META)

Formerly Facebook, Meta focuses on social media and virtual reality technologies. META shares are trading at $574.32, up by 0.90% from the previous close.

Visa Inc. (V)

A global leader in digital payments, Visa facilitates transactions worldwide. V is priced at $315.08, showing a 0.13% increase from the previous close.

Johnson & Johnson (JNJ)

Operating in pharmaceuticals, medical devices, and consumer health products, J&J maintains a strong market position. JNJ is trading at $155.01, with a slight decrease of 0.17% from the previous close.

These companies represent a diverse range of industries and have shown resilience and growth potential in the global market. Investors should conduct thorough research and consider their individual investment goals and risk tolerance before making investment decisions.

How to identify undervalued global stocks?

How to Identify Undervalued Global Stocks

Identifying undervalued global stocks requires a combination of research, analysis, and understanding of market dynamics. Here’s a step-by-step guide to finding stocks that trade below their intrinsic value, potentially offering excellent investment opportunities.

1. Understand What Makes a Stock Undervalued

An undervalued stock is one that trades for less than its intrinsic value, which is determined by the company’s fundamentals. The gap between the current market price and intrinsic value can result from temporary market conditions, negative sentiment, or lack of investor awareness.

2. Use Fundamental Analysis

Fundamental analysis focuses on the financial health and growth potential of a company. Key metrics to consider include:

Price-to-Earnings (P/E) Ratio

- Compare a company’s P/E ratio to industry averages or competitors.

- A lower-than-average P/E ratio might indicate the stock is undervalued.

Price-to-Book (P/B) Ratio

- This measures the market price relative to the company’s book value (assets minus liabilities).

- A P/B ratio below 1 often indicates an undervalued stock.

Price-to-Sales (P/S) Ratio

- This compares the company’s market capitalization to its revenue.

- A low P/S ratio suggests the stock may be undervalued compared to its sales.

Earnings Growth

- Check the company’s historical and projected earnings growth.

- Look for stocks with consistent growth that aren’t reflected in their current price.

3. Evaluate Financial Health

A company with strong financials is more likely to recover from being undervalued. Analyze:

- Debt-to-Equity Ratio: Lower ratios indicate less reliance on debt.

- Free Cash Flow: Companies generating steady cash flow are typically stable.

- Revenue Trends: Increasing revenue over time is a good sign.

4. Look for Dividend-Paying Stocks

Undervalued stocks with a history of consistent dividend payments may provide reliable returns even during market fluctuations. Evaluate:

- Dividend yield compared to industry peers.

- Dividend payout ratio (a sustainable ratio is typically below 60%).

5. Conduct Peer Comparison

Compare the stock to competitors within the same industry or sector. Key areas to analyze include:

- Valuation multiples (P/E, P/B, and P/S ratios).

- Market share and competitive positioning.

- Operational efficiency metrics like profit margins.

6. Use Discounted Cash Flow (DCF) Analysis

DCF analysis estimates a company’s intrinsic value by forecasting future cash flows and discounting them to the present value. If the calculated intrinsic value is higher than the current market price, the stock may be undervalued.

7. Monitor Market Sentiment

Sometimes, stocks become undervalued due to temporary market conditions or negative news. Track:

- Analyst reports and investor sentiment.

- News headlines and global events affecting the stock or industry.

- Insider buying activity, as it often indicates confidence in the company’s prospects.

8. Focus on Emerging Markets

Emerging markets often house undervalued stocks due to less investor attention. Look for:

- Companies in rapidly growing industries or regions.

- Stocks with strong fundamentals but lower trading volumes.

9. Use Stock Screeners

Leverage online tools and stock screeners to filter for undervalued stocks based on criteria like P/E ratios, P/B ratios, or dividend yields. Popular platforms include:

- Morningstar

- Yahoo Finance

- TradingView

- Zacks Investment Research

10. Watch for Turnaround Stories

Companies undergoing restructuring, launching new products, or entering new markets might be temporarily undervalued. Look for:

- Clear signs of improvement in financials or operations.

- Management teams with a history of successful turnarounds.

11. Examine Global Macro Trends

Global economic trends can influence stock valuations. For example:

- Renewable energy stocks may become undervalued during low oil prices.

- Tech stocks in emerging markets might trade at a discount despite strong growth potential.

12. Avoid Value Traps

Not all undervalued stocks are good investments. A value trap occurs when a stock appears undervalued but lacks growth potential due to fundamental issues. Avoid stocks with:

- Declining revenue and earnings trends.

- High debt levels and poor cash flow.

- Industries in long-term decline.

13. Diversify Your Portfolio

Even when identifying undervalued stocks, diversification reduces risk. Spread your investments across:

- Sectors: Tech, healthcare, consumer staples, etc.

- Regions: North America, Europe, Asia, emerging markets.

- Market Caps: Large-cap, mid-cap, and small-cap stocks.

14. Stay Patient

Identifying undervalued stocks is only half the battle. Patience is crucial, as it may take time for the market to recognize a stock’s true value.

Finding undervalued global stocks is a skill that requires diligent research and analysis. By focusing on strong fundamentals, using tools like stock screeners, and staying informed about global trends, you can uncover opportunities that align with your financial goals.

Invest wisely and continuously evaluate your portfolio to capitalize on undervalued stocks’ potential.

Can you list stocks by sector?

How to Identify Undervalued Global Stocks

Identifying undervalued global stocks requires a combination of research, analysis, and understanding of market dynamics. Here’s a step-by-step guide to finding stocks that trade below their intrinsic value, potentially offering excellent investment opportunities.

1. Understand What Makes a Stock Undervalued

An undervalued stock is one that trades for less than its intrinsic value, which is determined by the company’s fundamentals. The gap between the current market price and intrinsic value can result from temporary market conditions, negative sentiment, or lack of investor awareness.

2. Use Fundamental Analysis

Fundamental analysis focuses on the financial health and growth potential of a company. Key metrics to consider include:

Price-to-Earnings (P/E) Ratio

- Compare a company’s P/E ratio to industry averages or competitors.

- A lower-than-average P/E ratio might indicate the stock is undervalued.

Price-to-Book (P/B) Ratio

- This measures the market price relative to the company’s book value (assets minus liabilities).

- A P/B ratio below 1 often indicates an undervalued stock.

Price-to-Sales (P/S) Ratio

- This compares the company’s market capitalization to its revenue.

- A low P/S ratio suggests the stock may be undervalued compared to its sales.

Earnings Growth

- Check the company’s historical and projected earnings growth.

- Look for stocks with consistent growth that aren’t reflected in their current price.

3. Evaluate Financial Health

A company with strong financials is more likely to recover from being undervalued. Analyze:

- Debt-to-Equity Ratio: Lower ratios indicate less reliance on debt.

- Free Cash Flow: Companies generating steady cash flow are typically stable.

- Revenue Trends: Increasing revenue over time is a good sign.

4. Look for Dividend-Paying Stocks

Undervalued stocks with a history of consistent dividend payments may provide reliable returns even during market fluctuations. Evaluate:

- Dividend yield compared to industry peers.

- Dividend payout ratio (a sustainable ratio is typically below 60%).

5. Conduct Peer Comparison

Compare the stock to competitors within the same industry or sector. Key areas to analyze include:

- Valuation multiples (P/E, P/B, and P/S ratios).

- Market share and competitive positioning.

- Operational efficiency metrics like profit margins.

6. Use Discounted Cash Flow (DCF) Analysis

DCF analysis estimates a company’s intrinsic value by forecasting future cash flows and discounting them to the present value. If the calculated intrinsic value is higher than the current market price, the stock may be undervalued.

7. Monitor Market Sentiment

Sometimes, stocks become undervalued due to temporary market conditions or negative news. Track:

- Analyst reports and investor sentiment.

- News headlines and global events affecting the stock or industry.

- Insider buying activity, as it often indicates confidence in the company’s prospects.

8. Focus on Emerging Markets

Emerging markets often house undervalued stocks due to less investor attention. Look for:

- Companies in rapidly growing industries or regions.

- Stocks with strong fundamentals but lower trading volumes.

9. Use Stock Screeners

Leverage online tools and stock screeners to filter for undervalued stocks based on criteria like P/E ratios, P/B ratios, or dividend yields. Popular platforms include:

- Morningstar

- Yahoo Finance

- TradingView

- Zacks Investment Research

10. Watch for Turnaround Stories

Companies undergoing restructuring, launching new products, or entering new markets might be temporarily undervalued. Look for:

- Clear signs of improvement in financials or operations.

- Management teams with a history of successful turnarounds.

11. Examine Global Macro Trends

Global economic trends can influence stock valuations. For example:

- Renewable energy stocks may become undervalued during low oil prices.

- Tech stocks in emerging markets might trade at a discount despite strong growth potential.

12. Avoid Value Traps

Not all undervalued stocks are good investments. A value trap occurs when a stock appears undervalued but lacks growth potential due to fundamental issues. Avoid stocks with:

- Declining revenue and earnings trends.

- High debt levels and poor cash flow.

- Industries in long-term decline.

13. Diversify Your Portfolio

Even when identifying undervalued stocks, diversification reduces risk. Spread your investments across:

- Sectors: Tech, healthcare, consumer staples, etc.

- Regions: North America, Europe, Asia, emerging markets.

- Market Caps: Large-cap, mid-cap, and small-cap stocks.

14. Stay Patient

Identifying undervalued stocks is only half the battle. Patience is crucial, as it may take time for the market to recognize a stock’s true value.

Finding undervalued global stocks is a skill that requires diligent research and analysis. By focusing on strong fundamentals, using tools like stock screeners, and staying informed about global trends, you can uncover opportunities that align with your financial goals.

Invest wisely and continuously evaluate your portfolio to capitalize on undervalued stocks’ potential.

Stocks Listed by Sector

Investing in stocks by sector allows you to diversify your portfolio and align investments with economic trends. Here’s a breakdown of major sectors and top-performing stocks within each:

1. Technology Sector

This sector focuses on innovation and includes companies that manufacture electronic products, develop software, or provide IT services.

- Apple Inc. (AAPL): Known for its consumer electronics like iPhones and MacBooks.

- Microsoft Corporation (MSFT): A leader in cloud computing and software solutions.

- NVIDIA Corporation (NVDA): Specializes in AI, gaming, and graphics processing units.

- Alphabet Inc. (GOOGL): Parent company of Google, dominating search and advertising.

- Meta Platforms Inc. (META): Focused on social media and virtual reality innovations.

2. Healthcare Sector

Healthcare stocks include pharmaceutical companies, medical device makers, and healthcare providers.

- Johnson & Johnson (JNJ): Offers pharmaceuticals, medical devices, and consumer health products.

- Pfizer Inc. (PFE): Known for its vaccine development and pharmaceuticals.

- Moderna Inc. (MRNA): A leader in mRNA-based therapies.

- UnitedHealth Group (UNH): A giant in health insurance and healthcare services.

- AbbVie Inc. (ABBV): Focused on immunology and oncology treatments.

3. Financial Sector

The financial sector includes banks, insurance companies, and asset management firms.

- JPMorgan Chase & Co. (JPM): A leading global financial services provider.

- Bank of America (BAC): Specializes in banking and investment management.

- Goldman Sachs Group (GS): Known for investment banking and financial advisory.

- Berkshire Hathaway Inc. (BRK.A): A diversified holding company with investments across industries.

- Visa Inc. (V): A global leader in digital payments.

4. Energy Sector

This sector covers companies involved in oil, gas, and renewable energy production.

- Exxon Mobil Corporation (XOM): Focused on oil and gas exploration and production.

- Chevron Corporation (CVX): Another major player in traditional energy markets.

- NextEra Energy Inc. (NEE): A leader in renewable energy.

- Tesla Inc. (TSLA): While primarily an EV manufacturer, it’s also involved in solar and energy storage solutions.

- First Solar Inc. (FSLR): Specializes in solar panel manufacturing.

5. Consumer Staples

These are companies that produce essential products, such as food, beverages, and household goods.

- Procter & Gamble Co. (PG): Known for its wide range of consumer goods.

- Coca-Cola Company (KO): A global leader in beverages.

- PepsiCo Inc. (PEP): Offers beverages and snack products.

- Walmart Inc. (WMT): A retail giant with a strong focus on everyday essentials.

- Colgate-Palmolive Co. (CL): Focuses on oral care and personal hygiene products.

6. Consumer Discretionary

This sector includes companies selling non-essential goods and services.

- Amazon.com Inc. (AMZN): Dominates e-commerce and cloud computing.

- Nike Inc. (NKE): A leader in athletic footwear and apparel.

- Starbucks Corporation (SBUX): A global coffeehouse chain.

- The Home Depot Inc. (HD): Specializes in home improvement retail.

- Disney (Walt) Co. (DIS): A leader in entertainment and streaming services.

7. Industrials

Industrials include companies in manufacturing, defense, and construction.

- Boeing Co. (BA): A major player in aerospace and defense.

- Caterpillar Inc. (CAT): Specializes in construction and mining equipment.

- 3M Company (MMM): Known for industrial and consumer products.

- Honeywell International Inc. (HON): Focused on aerospace, building technologies, and performance materials.

- General Electric Co. (GE): A diversified industrial leader.

8. Real Estate

The real estate sector includes real estate investment trusts (REITs) and property developers.

- American Tower Corp. (AMT): Specializes in communication infrastructure.

- Prologis Inc. (PLD): Focused on logistics real estate.

- Simon Property Group (SPG): A leader in retail real estate.

- Equinix Inc. (EQIX): Operates data center properties.

- Realty Income Corp. (O): Known for monthly dividends.

9. Utilities

Utilities provide essential services like electricity, water, and gas.

- Duke Energy Corporation (DUK): Supplies electricity and natural gas.

- NextEra Energy Inc. (NEE): A leader in renewable energy generation.

- Southern Company (SO): Provides energy solutions.

- Dominion Energy Inc. (D): Specializes in energy production and distribution.

- American Electric Power Co. (AEP): A major electric utility provider.

10. Materials

This sector includes companies producing raw materials like metals, chemicals, and paper.

- The Sherwin-Williams Company (SHW): Known for paints and coatings.

- Linde PLC (LIN): A leader in industrial gases.

- Newmont Corporation (NEM): A top gold mining company.

- Dow Inc. (DOW): Specializes in chemicals and materials science.

- Freeport-McMoRan Inc. (FCX): Focuses on mining and production of copper and gold.

11. Communication Services

This sector includes media, entertainment, and telecommunication companies.

- Alphabet Inc. (GOOGL): Dominates online advertising and search.

- Meta Platforms Inc. (META): A leader in social networking and virtual reality.

- Netflix Inc. (NFLX): A global streaming giant.

- Verizon Communications Inc. (VZ): A leading telecommunications provider.

- AT&T Inc. (T): Focuses on telecommunications and media services.

Conclusion

By understanding these sectors and the top-performing companies within them, you can better diversify your investments and align them with your financial goals. Be sure to conduct thorough research and consider economic trends before making investment decisions.

What are the safest stocks globally?

Investing in stable, well-established companies can provide a measure of safety in your portfolio. These companies often have strong financials, consistent earnings, and a history of weathering economic downturns. Here are some of the safest stocks globally, categorized by sector:

1. Healthcare Sector

- Johnson & Johnson (JNJ): A diversified healthcare giant with operations in pharmaceuticals, medical devices, and consumer health products. Its broad portfolio contributes to its stability. The Fool

2. Consumer Staples Sector

- Procter & Gamble Co. (PG): Known for its wide range of household and personal care products, P&G has a strong global presence and a reputation for consistent performance. Kiplinger

- Coca-Cola Co. (KO): As a leading beverage company with a vast global footprint, Coca-Cola’s extensive product line and brand recognition contribute to its resilience. Kiplinger

3. Technology Sector

- Microsoft Corporation (MSFT): A leader in software, cloud computing, and hardware, Microsoft’s diversified business model and strong financials make it a reliable investment. Money

- Apple Inc. (AAPL): Renowned for its innovative consumer electronics and services, Apple’s strong brand loyalty and consistent revenue streams add to its stability. Money

4. Financial Sector

- Visa Inc. (V): As a global payments technology company, Visa benefits from the ongoing shift to digital transactions, providing a steady revenue base. Money

5. Communication Services Sector

- Alphabet Inc. (GOOGL): The parent company of Google, Alphabet dominates the online search and advertising markets, offering diversified revenue streams. Money

6. Consumer Discretionary Sector

- Amazon.com Inc. (AMZN): A global leader in e-commerce and cloud computing, Amazon’s expansive operations across various sectors contribute to its growth and stability. Money

7. Conglomerates

- Berkshire Hathaway Inc. (BRK.A): Led by Warren Buffett, this conglomerate has diverse holdings across multiple industries, providing a balanced and stable investment. Yahoo Finance

8. Energy Sector

- Exxon Mobil Corp. (XOM): As one of the world’s largest publicly traded energy providers, Exxon’s integrated business model and global operations offer resilience against market volatility. Yahoo Finance

These companies are recognized for their financial strength, market leadership, and ability to generate consistent earnings, making them some of the safer investment options globally. However, it’s essential to conduct thorough research and consider your individual investment goals and risk tolerance before making investment decisions.

Can you suggest beginner-friendly stocks?

Beginner-Friendly Stocks to Consider

For those new to investing, beginner-friendly stocks are characterized by stability, strong brand recognition, and a track record of consistent performance. These stocks typically belong to well-established companies that are less volatile, making them ideal for novice investors.

Here’s a list of beginner-friendly stocks by sector:

1. Technology Sector

The technology sector offers stocks with high growth potential, and some companies are relatively stable and beginner-friendly.

- Apple Inc. (AAPL): Known for its innovative products and loyal customer base, Apple is a global leader in consumer electronics.

- Microsoft Corporation (MSFT): A pioneer in software and cloud computing, Microsoft offers consistent growth and dividend payments.

- Alphabet Inc. (GOOGL): As the parent company of Google, Alphabet is a dominant force in online advertising and cloud services.

2. Consumer Staples Sector

This sector is ideal for beginners because it includes companies that produce essential goods, ensuring demand even during economic downturns.

- Procter & Gamble Co. (PG): With a portfolio of trusted brands like Tide, Gillette, and Pampers, P&G is a stable choice for beginners.

- Coca-Cola Co. (KO): A globally recognized beverage company with a long history of dividend payments.

- PepsiCo Inc. (PEP): Offers both beverages and snacks, diversifying its revenue streams and making it a resilient stock.

3. Healthcare Sector

Healthcare companies provide stability due to the consistent demand for medical products and services.

- Johnson & Johnson (JNJ): A diversified healthcare giant with a strong track record and dividend history.

- Pfizer Inc. (PFE): Known for its pharmaceutical innovations, including vaccines and treatments.

- UnitedHealth Group (UNH): A leader in health insurance and healthcare services.

4. Financial Sector

The financial sector includes companies that provide banking, payment, and investment services.

- Visa Inc. (V): A global leader in payment technology with a stable revenue base.

- Mastercard Inc. (MA): Similar to Visa, Mastercard benefits from the growing shift to cashless transactions.

- JPMorgan Chase & Co. (JPM): A well-established bank with diversified revenue streams.

5. Consumer Discretionary Sector

This sector features companies that produce non-essential goods and services, which often perform well in growing economies.

- Amazon.com Inc. (AMZN): A global leader in e-commerce and cloud computing, Amazon offers long-term growth potential.

- The Home Depot Inc. (HD): A dominant player in the home improvement retail market.

- Nike Inc. (NKE): A globally recognized brand in athletic footwear and apparel.

6. Utilities Sector

Utilities provide essential services like electricity and water, making them a stable choice for beginners.

- Duke Energy Corporation (DUK): A major energy provider in the U.S. with a focus on renewable energy.

- NextEra Energy Inc. (NEE): Known for its leadership in renewable energy production.

- American Electric Power Co. (AEP): Provides consistent returns through stable energy services.

7. Energy Sector

Energy companies can offer stable returns, especially those with diversified operations.

- Exxon Mobil Corporation (XOM): A global leader in oil and gas production with a strong dividend history.

- Chevron Corporation (CVX): Known for its integrated energy operations and reliable performance.

8. Real Estate Sector

Real Estate Investment Trusts (REITs) are a beginner-friendly way to invest in real estate without owning property.

- Realty Income Corp. (O): A REIT that pays monthly dividends, often called “The Monthly Dividend Company.”

- Prologis Inc. (PLD): Specializes in logistics and industrial real estate.

- American Tower Corp. (AMT): Focuses on communication infrastructure, such as cell towers.

9. ETFs for Diversification

If selecting individual stocks feels overwhelming, beginners can consider Exchange-Traded Funds (ETFs) for instant diversification:

- SPDR S&P 500 ETF (SPY): Tracks the performance of the S&P 500 index, providing exposure to 500 leading companies.

- Vanguard Total Stock Market ETF (VTI): Offers exposure to the entire U.S. stock market.

- iShares MSCI World ETF (URTH): Provides access to large and mid-cap companies globally.

Tips for Beginners When Investing in Stocks

- Start Small: Invest an amount you’re comfortable with and gradually increase as you learn.

- Diversify: Avoid putting all your money in one stock or sector.

- Focus on Long-Term Growth: Ignore short-term market fluctuations and hold onto quality stocks.

- Use Fractional Shares: Platforms like Robinhood and Fidelity allow you to buy fractional shares of expensive stocks.

- Research Regularly: Learn about the companies you invest in and stay updated on market trends.

By starting with these beginner-friendly stocks, you can build a stable and diversified portfolio while gaining confidence in your investment journey.